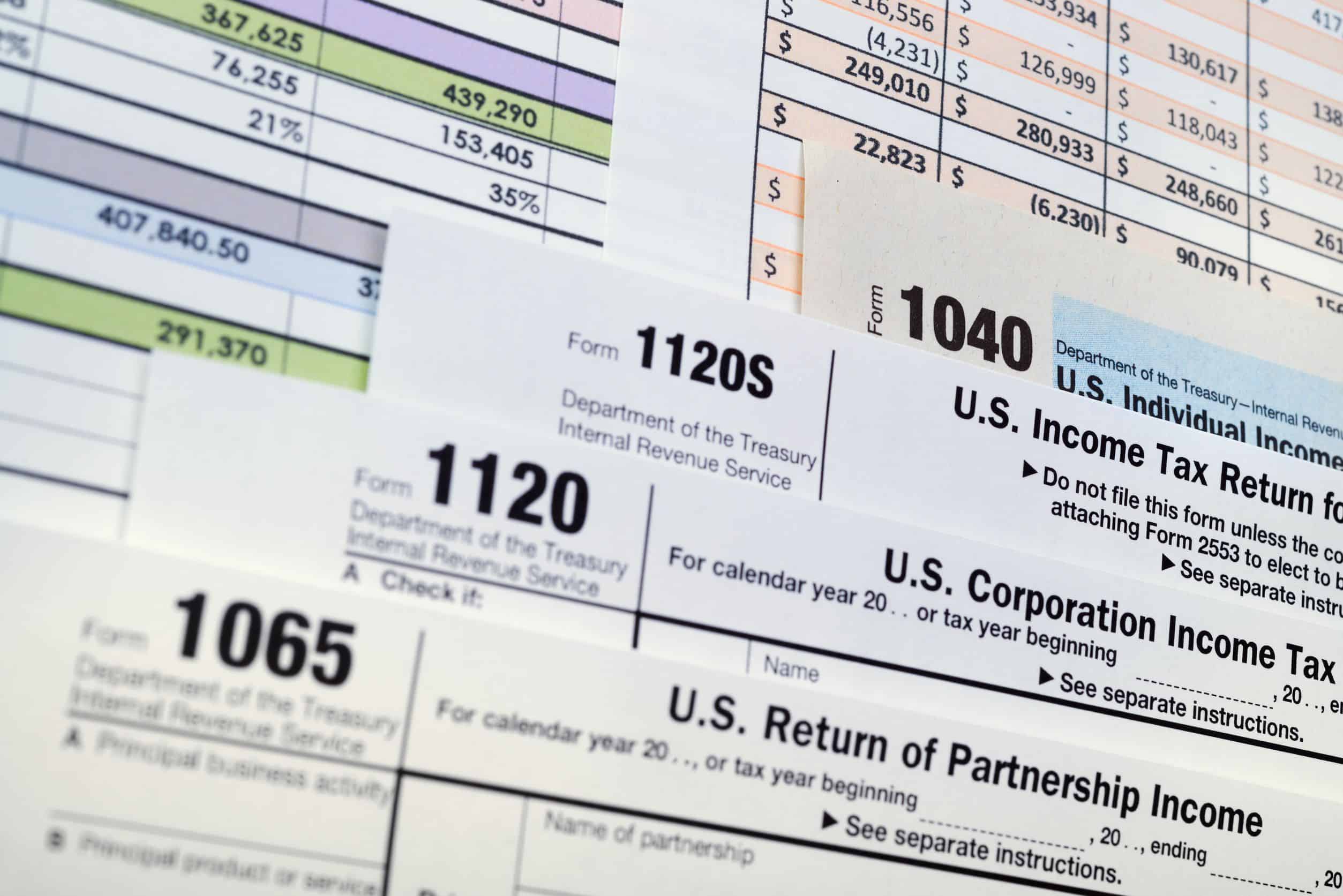

The date at which the tax expires and is no longer legally collectible is. Tax reduction programs under federal law provide real relief but they can be very complexed to navigate.

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

If you have received multiple notices from the IRS the agency may have placed a lien on your assets in its attempt to collect debts.

. IRS Installment Agreements and Fresh Start. Thursday June 9 2022. Expanded Penalty Relief Now expired IRS Fresh Start Tax Lien Changes.

It is the federal governments reaction to the IRSs predatory methods which include the use of compound interest and financial penalties to penalize. The Fresh Start program increased the amount that taxpayers can owe before the IRS generally will file a Notice of Federal Tax Lien. Access to affordable quality food is critical to building strong neighborhoods.

IRS Installment Agreements. The 72 month Fresh Start installment agreement must pay all tax periods within the statute. Bankruptcy Fresh Start Program The What And Why Day One Credit.

Read and understand all terms prior to enrollment. We do not assume tax debt make monthly payments to creditors or provide tax bankruptcy accounting or legal advice. Before Fresh Start Initiative Expires.

Before the Fresh Start Initiative the IRS issued tax liens for all kinds of liability levels. The Food Retail Expansion to Support Health FRESH program brings healthy and affordable food options to communities by lowering the costs of owning leasing developing and renovating supermarket retail space. Thanks to the Fresh Start Program it is now easier for taxpayers to qualify for a streamlined IRS installment agreement.

Many people wonder if the Fresh Start Initiative is still in place today in 2019. Irs Partial Payment Installment Agreement The W Tax Group. IRS Fresh Start Qualification Assistance.

The Fresh Start program can help you remove tax liens while. Individual results may vary based on ability to save funds and completion of all program terms. By providing your contact information you expressly consent to receiving calls andor SMS text messages at the number you provided as part of our.

I use this in the dentist chair Hold one hand in front. Under the new rules the IRS does not issue tax liens if the tax owed is less than 10000. Government in 2011The Fresh Start Initiative Program offers tax assistance to a certain crowd of people who owe the IRS money.

Prior to obtaining a building permit the proposed store must be certified as a FRESH food store by the Chairperson of the City Planning Commission CPC verifying that the store meets the floor area requirements the. The Fresh Start initiative offers taxpayers the following ways to pay their tax debt. Now with the Fresh Start program taxpayers can pay off their tax debts through the different IRS-approved installment plans.

Bankruptcy Fresh Start Program The What And Why Day One Credit. That amount is now 10000. This is to help willing taxpayers pay off debts without any undue financial hardship.

A developer seeking to utilize the zoning incentives of the FRESH Program must demonstrate that the primary business of the retail space is the sale of food products. IRS Fresh Start Initiative is a tax resolution firm independent from the IRS. The Fresh Start initiative makes it possible to pay smaller amounts over a longer period of time without getting penalized.

However in some cases the IRS may still file a lien notice on amounts less than 10000. Note that there are rare exceptions to this rule. If youre experiencing or worried about liens levies garnishments or more now is the time to learn about your options to protect yourself and resolve your tax burden.

The Fresh Start Program also known as the Fresh Start Initiative was established by the US. Fresh start initiative expires. Since launching in 2009 28 projects have been approved for FRESH tax incentives.

Generally the IRS has 10 years to collect the tax from the date of assessment. Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program. Program does not assume any debts nor provide legal or tax advice.

The payment option may be as long as 72 months or six years. Try this simple five-finger breathing exercise you can do anywhere. The debt must be paid off within 5 years 60 months or before the CSED Collection Statute Expiration Date expires whichever occurs first.

Check If You Qualify For Free. Fresh start initiative expires Friday April 8 2022 Edit This initiative also increased allowable living expenses and changed the way applicants financial situations were analyzed to make this program more accessible for many taxpayers with outstanding tax debts. So in short the Fresh Start Initiative is still in place in 2019.

While there have been changes to IRS procedures after the Fresh Start Initiative was enacted these have generally only served to expand the benefits of the Fresh Start Initiative.

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

Irs Partial Payment Installment Agreement The W Tax Group

Here S What It Looks Like When A 112 000 Irs Balance Expires Landmark Tax Group

Irs Fresh Start Program Guide With 2021 Updates Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

What Is The Irs Fresh Start Program 72 Month Installment Agreement

Program Helps People Get Fresh Start Fox 59

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

The Irs Tax Debt Forgiveness Program Explained

Bankruptcy Fresh Start Program The What And Why Day One Credit

Bankruptcy Fresh Start Program The What And Why Day One Credit

Here S What It Looks Like When A 112 000 Irs Balance Expires Landmark Tax Group

Tax Lien What It Is And How To Stop One

What Is The Irs Statute Of Limitations On Collecting Tax Debt Atlanta Tax Lawyers

Bankruptcy Fresh Start Program The What And Why Day One Credit

How To Remove A Tax Lien From Public Record Community Tax

Bankruptcy Fresh Start Program The What And Why Day One Credit

Bankruptcy Fresh Start Program The What And Why Day One Credit